Wills, Enduring Guardianship & Powers of Attorney

TAKE THE NEXT STEP TO PROTECT YOURSELF AND THOSE YOU LOVE BY ENSURING THAT YOUR WISHES ARE CARRIED OUT

DO I REALLY NEED A WILL YOU MAY ASK?

There are several important reasons as to why you should consider taking out a Will and allow ESCOBAR & ASSOCIATES SOLICITORS to professionally draft your Will.

The Will is a legal document designed to ensure that your family’s needs are met according to your wishes should you pass away.

The Will accomplishes this by enabling you to distribute your wealth and assets accordingly between those dear to you, such as your family members, friends, church, favourite charity, beloved pet etc.

The Will can also enable you to make more specific requests, such as:

- exclude immediate family members from being recipients of your estate;

- specify who you will entrust with the guardianship of your children;

- enable you to provide for children with special needs;

- enable you to include and provide for children from a previous relationship; or

- specify which assets do not form part of your estate.

These are just some of the many requests a Will can enable you to carry out.

If you do not have a Will, the distribution of your wealth and assets will be carried out by an administrator

which will be appointed by the court. This process could take months to eventuate, there will be no

certainty that your dependants, blood relatives or charity for example, will receive what you may

have intended, and will most likely cause unnecessary anxiety, confusion and unnecessary costs to them.

OR AN ENDURING POWER OF ATTORNEY?

Unlike a Will, an Enduring Power of Attorney is a legal document that authorises another person, or people

that you trust (depending on the laws of your state), to make decisions about your property, manage

your financial affairs, and/or sign on your behalf, subject to any conditions or limitations that you have set

out in the document, sometime in the future, whilst you are alive and have lost your mental capacity to

do so (e.g. if you develop dementia, have a stroke or sustain a brain injury in a car accident).

The Enduring Power of Attorney will enable the other person/s to:

- pay your bills;

- collect debts;

- operate a bank account;

- sell or buy property; or

- perform any other functions which you may have lawfully delegated to them.

The Enduring Power of Attorney will generally cease to give the other person/s the authority to act on

your behalf when either you (provided you have the mental capacity to do so) give notice of revocation,

preferably in writing, your attorney notifies you that they will no longer act under the power, you have

appointed only one attorney and they cannot continue in their role, you or your attorney pass away

or become bankrupt.

The Enduring Power of Attorney will not however permit your attorney to make personal, medical or

lifestyle decisions for you.

If you do not have an Enduring Power of Attorney and you lose your mental capacity there may be no

one with legal authority to manage your financial affairs. This may mean that your family may have

difficulty in conducting your financial and business affairs, and nothing can be bought or sold.

Under these circumstances your family may have to apply to the Guardianship Tribunal to obtain a

formal Order to enable them to look after your basic needs and transactions, and this could be a

very stressful, inconvenient and costly process for the ones you love. Otherwise, if there is no one

with authority, the State will have to appoint a financial manager for you and your financial affairs will

be managed as they see fit.

APPOINT AN ENDURING GUARDIAN?

An Enduring Guardian is a person, or persons you choose to make personal, health or lifestyle decisions

on your behalf, sometime in the future, when you lose your capacity to do so (e.g. if you develop dementia,

have a stroke or sustain a brain injury in a car accident), subject to any conditions or limitations you have

set out in the document.

An Enduring Guardian can be authorised to decide for example:

- where you may need to live;

- what personal services may come to your home (i.e. cleaning, therapy and who can speak to your doctor about your medication etc.); or

- what medical treatment you should receive;

An Enduring Guardian cannot consent to anything unlawful and cannot:

- make a will for you;

- vote on your behalf;

- consent to marriage

- manage your finances; or

- override your objections, if any, to medical treatment.

If you don’t elect to have an Enduring Guardian the Guardianship Tribunal will decide who will be

responsible in making your personal decisions. If there is any uncertainty about a person's right to

make personal decisions on your behalf, then the interested person may apply to the Guardianship

Tribunal for an order to be appointed as guardian.

This is why deciding to elect an Enduring Guardian will ease the burden, stress and any chances

of disputes arising between your loved ones as to who has been appointed as your guardian.

Additionally, if you are going to appoint an Enduring Guardian, it is also advisable to take out an

Advanced Health Care Directive.

AN ADVANCED HEALTH CARE DIRECTIVE?

An Advanced Health Care Directive (AHCD) or sometimes called a living will, is specifically useful if

you have an incurable or terminal illness. An AHCD can be legally binding, and allows you to set out

in advance, and in confidence, how you would like to receive any future medical treatment for various

medical conditions in case you are unable to make such decisions.

The AHCD can ensure that you will not be given unwanted medical treatment at the end of your life and

will make it easier for your loved ones and health care providers to understand and respect your wishes.

OR MAYBE JUST A GENERAL POWER OF ATTORNEY?

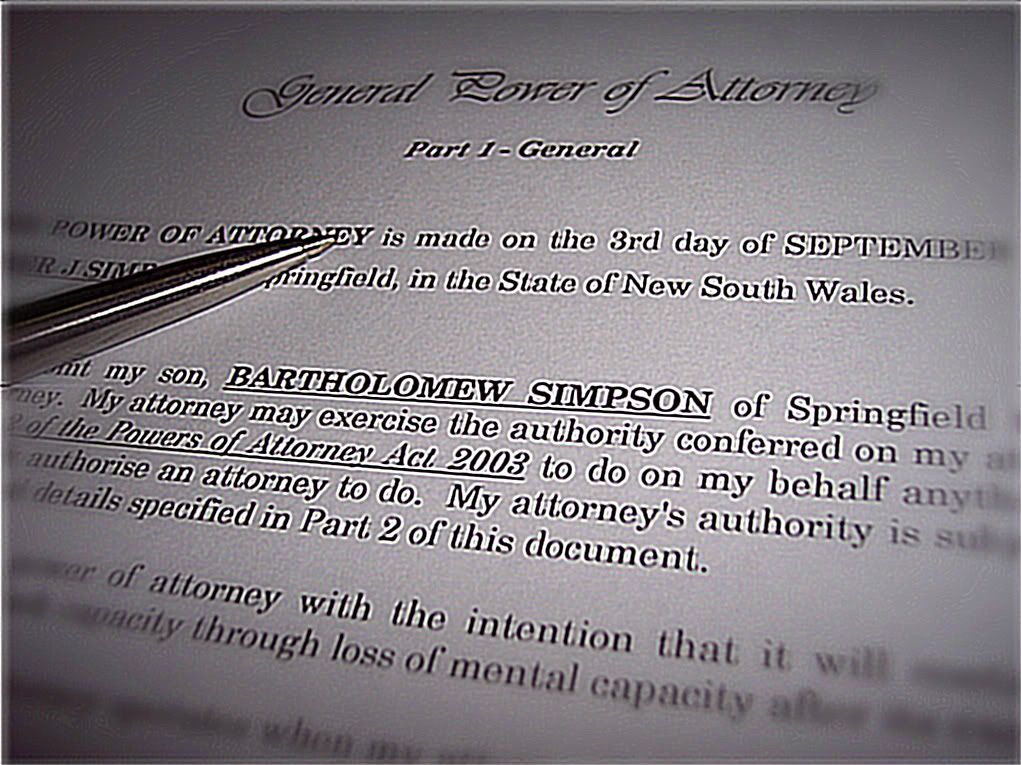

Unlike the Enduring Power of Attorney, a General Power of Attorney authorises another person, or people,

to sign and/or do certain things for you on your behalf, subject to any conditions or limitations set

in the document, whilst you are alive and have not lost your mental capacity.

As with the Enduring Power of Attorney, there are also several important reasons why you should consider whether taking out a General Power of Attorney would be a better option for you under your current circumstances.

The General Power of Attorney is very useful

when you are unable to manage your affairs personally personally, such as if you become ill, will be travelling overseas or find it hard to read and/or sign documents due to loss of vision and/or difficulty in writing.

The General Power of Attorney will enable the other person/s to:

- pay your bills;

- collect debts;

- vote at meetings;

- operate a bank account;

- buy or sell property; or

- perform any other function which you may have lawfully delegated to them.

However, the General Power of Attorney will not permit your attorney to make personal, medical

or lifestyle decisions for you.

The General Power of Attorney will generally cease to give the other person/s the authority to act on

your behalf when either you give notice of revocation, preferably in writing, your attorney notifies you

that they will no longer act under the power, you or your attorney loose the mental capacity,

pass away or become bankrupt.

So please feel free to contact and discuss with ESCOBAR & ASSOCIATES SOLICITORS about

which of the above stated options would be most suitable for your needs. We will come to you free

of charge and discuss with you, in straight plain English, what are your specific wishes, assist you

in drafting your Will, prepare your Enduring or General Power of Attorney, compose your Advance

Health Care Directive or appoint an Enduring Guardian for you, all depending on your specific, personal

and financial circumstances.